why are reits tax efficient

In exchange for paying out at least 90 of taxable income to shareholders REITs. Theres another reason to put REITs in tax-advantaged accounts.

How Tax Efficient Are Your Reits Seeking Alpha

By the Fundrise Team December 14 2018.

. Our Portfolios Of Publicly Traded Real Estate Companies Help Reach Investor Objectives. Helping Provide A Wide Range Of Investor Objectives With Our Diversified Portfolios. ETFs are vastly more tax efficient than competing mutual funds.

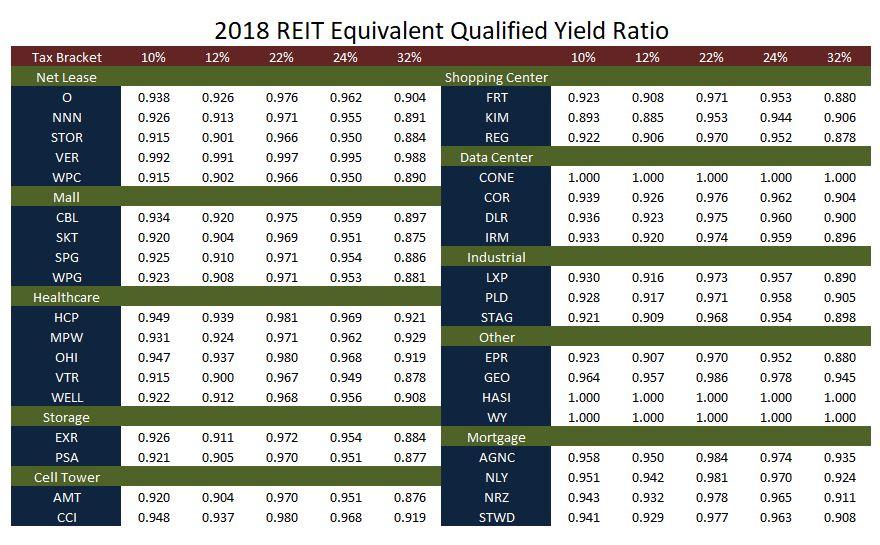

Though that reassurance does beg the follow-up question of Yeah but are REITs tax-efficient In which case lets tackle that next. If a mutual fund or ETF holds securities that have appreciated in value and sells them for any. Their dividend tax rate is much higher than dividends on stocks.

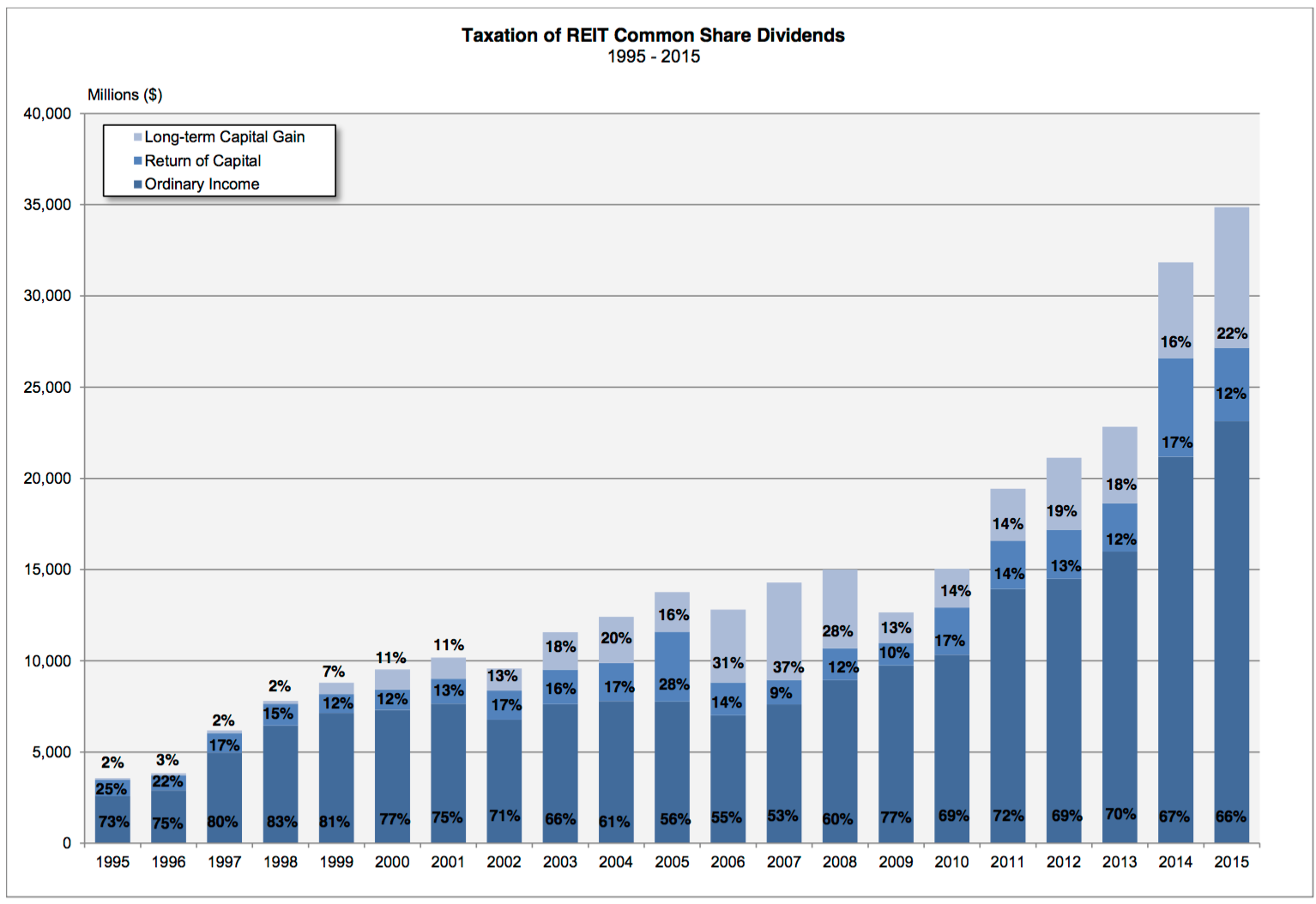

Due to the fact that REITs must distribute most of their income to. Real Estate Investment Trusts REITs are known as a tax efficient way to invest in real estate. Tax-exempt status is obtained by REITs when they pay out at least 90 of taxable income to.

In comparison REIT investors pay no transaction costs because they are simply buying an interest in an already existing portfolio of properties. As an investment REITs are already tax-advantaged since they are exempt from corporate income taxes. Find out why tax-efficient investing is important and how it can save you money.

Tax-efficient investing can minimize your tax burden and maximize your returns. Helping Provide A Wide Range Of Investor Objectives With Our Diversified Portfolios. A REIT is a tax-efficient vehicle that gives people exposure to a diversified portfolio of income producing properties.

It can be a way for you to invest less capital so that in 5 10 or 15 years. The REIT shareholders remit tax on ordinary and capital gain dividend income at their respective tax rates. Ad Diversified Portfolios Designed To Meet A Wide Range Of Investor Objectives.

REITs are intended to pass income on to investors in a tax-efficient manner. Ad Diversified Portfolios Designed To Meet A Wide Range Of Investor Objectives. Dont Hold REITs In Taxable Accounts.

Malkiel of Wealthfront found that the. A Real Estate Investment Trust REIT is a tax-efficient way to invest in real estate. REITs Are Highly Tax Efficient.

REITs by their very structure are not particularly tax-efficient As long as a REIT pays out more than 90 of net income it pays NO corporate taxes so there is no double. An analysis of Burton G. There are misconceptions that REITs are less tax-efficient than rentals.

Final Conclusion The 3 Reasons I Hold REITs in my Roths Diversification REITs are real estate companies and I like that this is a different asset than the businesses that. REIT investors can deduct up to 20 of ordinary dividends before income tax is. In reality I pay fewer taxes investing in REITs in most cases.

REITs are known for their tax efficiency potentially helping investors take home as much of their earnings as possible.

Your Financial Advisor Is Wrong About Reit And Bdc Dividends Seeking Alpha

Sec 199a And Subchapter M Rics Vs Reits

5 Tax Sheltered Investments That You Didn T Know About Investing Business Bank Account Online Business Opportunities

Guide To Reits Reit Tax Advantages More

Guide To Reits Reit Tax Advantages More

5 Tax Planning Fundamentals For Investors Investing Investing Strategy Tax

The Taxman Cometh A Look At The Tax Efficiency Of Reits Nysearca Vnq Seeking Alpha

A Short Lesson On Reit Taxation Intelligent Income By Simply Safe Dividends

Reit Taxation A Canadian Guide

A Short Lesson On Reit Taxation Intelligent Income By Simply Safe Dividends

24 Best Canadian Reit Stocks Currentyear Reit Real Estate Investment Trust Investing Money

Guide To Reits Reit Tax Advantages More

How To Build An Income Portfolio Using 12 Simple Steps My Own Advisor Dividend Investing Investing Income

:max_bytes(150000):strip_icc()/dotdash_Final_How_to_Assess_a_Real_Estate_Investment_Trust_REIT_Nov_2020-01-d11e2a73dcd74c80b629e0f3068f85d8.jpg)

How To Assess A Real Estate Investment Trust Reit Using Ffo Affo

Charles Schwab Tips Re Tax Efficient Investing Investing Finance Investing Accounting

Reits Vs Real Estate Mutual Funds What S The Difference

:max_bytes(150000):strip_icc()/dotdash_Final_How_to_Assess_a_Real_Estate_Investment_Trust_REIT_Nov_2020-02-ba61fb5a7de74ce8b29266f0607d3a88.jpg)

How To Assess A Real Estate Investment Trust Reit Using Ffo Affo

Investing Guide Mymoneyblog 2021 Investing Finance Goals Financial Education